Award-winning PDF software

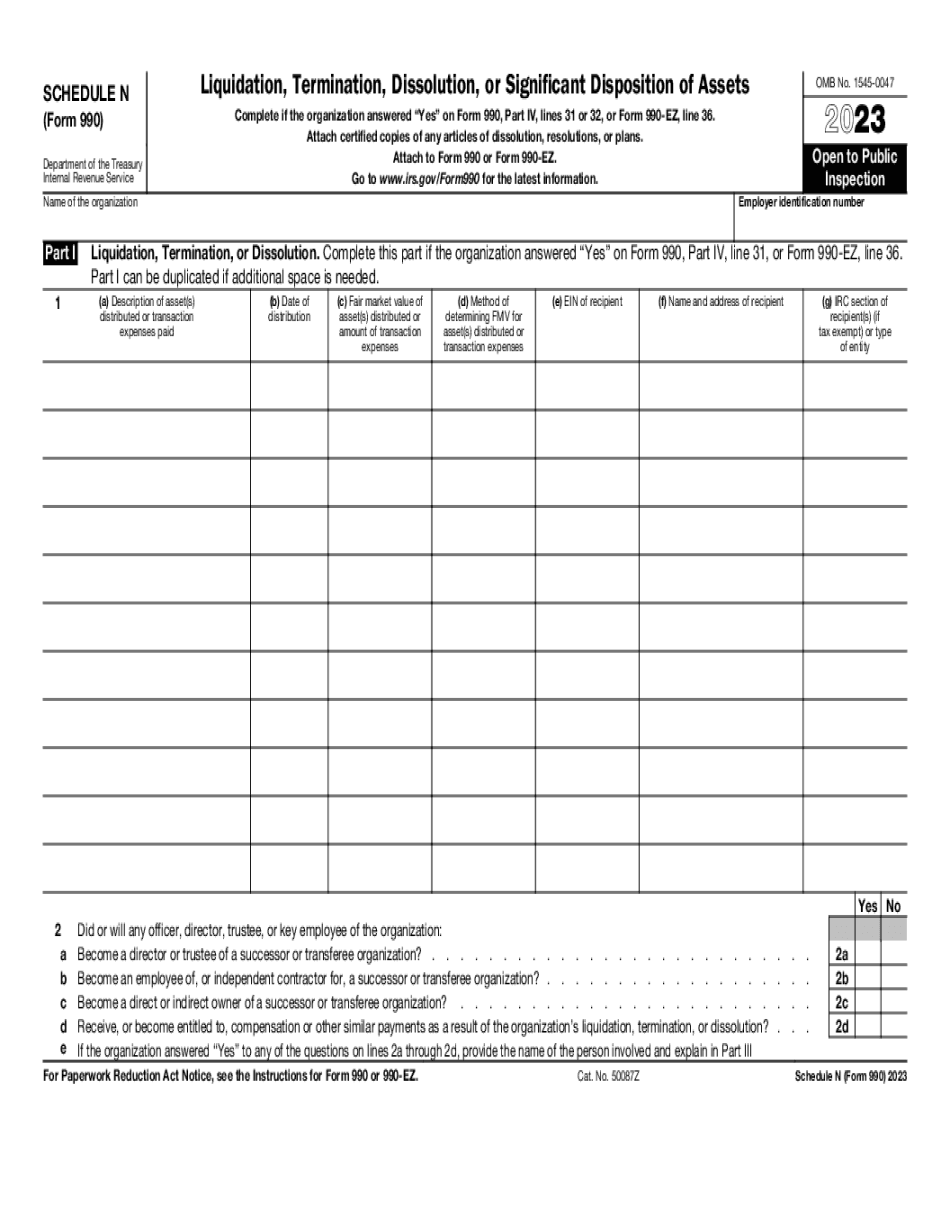

California online Form 990 or 990-EZ - Schedule N: What You Should Know

Federal Tax Administration, Federal Taxation and the 990 Program. There is no need to file Form 990 at the time for which we are filing it, but we are required to file the 990-EZ. This form, if filed, will show our status as a tax-exempt educational organization. IRS Form 990-EZ | IRS Part II Financial Statements and Reports. A financial statement must be prepared by auditors when a nonprofit is in financial difficulty. A financial statement is a summary of financial information. The annual financial statements must cover the organization's years preceding the filing of the 990. A financial statement can be a consolidated statement of operations over the course of the year or a separate statement of operations for the organization's last fiscal year. The financial statements must be on a form approved by an accounting firm or the Internal Revenue Service, and must show: All income; All expenses; and The assets of the organization (including cash and cash equivalents), and the balance of the organization's reserves from the financial year ending. Financial Statements. These can be on paper or electronic media. Annual financial statements. A nonprofit organization that receives substantial amounts of public grants that it distributes must prepare its books and records in accordance with Federal and State laws and regulations. Filing and Paying Fees Form 990-EZ and Form 990-N are the primary ways to report the activities and operations of a tax-exempt educational organization, but they do not cover all the requirements and costs involved in filing tax returns and paying taxes. In order to minimize fees and prepare accurate tax returns, most tax-exempt tax-foreclosure organizations operate “on the ground” by working in the community. When an organization does not have sufficient funds either to pay or to hire a professional, it generally turns to another nonprofit tax-foreclosure organization for assistance. In contrast, in order to prepare an accurate 990, the organization must have financial resources and the ability to hire an accountant. Form 990-EZ and Form 990-N are the two primary forms for nonprofit organizations to file annual reports, and most nonprofits use only one form. When an organization does both, they are required to file Form 990-EZ if more than 50% of the activities in the organization's organization were the direct, qualified support of another, taxpayer-funded (such as grant) scholarship, fellowship, or program.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete California online Form 990 or 990-EZ - Schedule N, keep away from glitches and furnish it inside a timely method:

How to complete a California online Form 990 or 990-EZ - Schedule N?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your California online Form 990 or 990-EZ - Schedule N aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your California online Form 990 or 990-EZ - Schedule N from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.