Award-winning PDF software

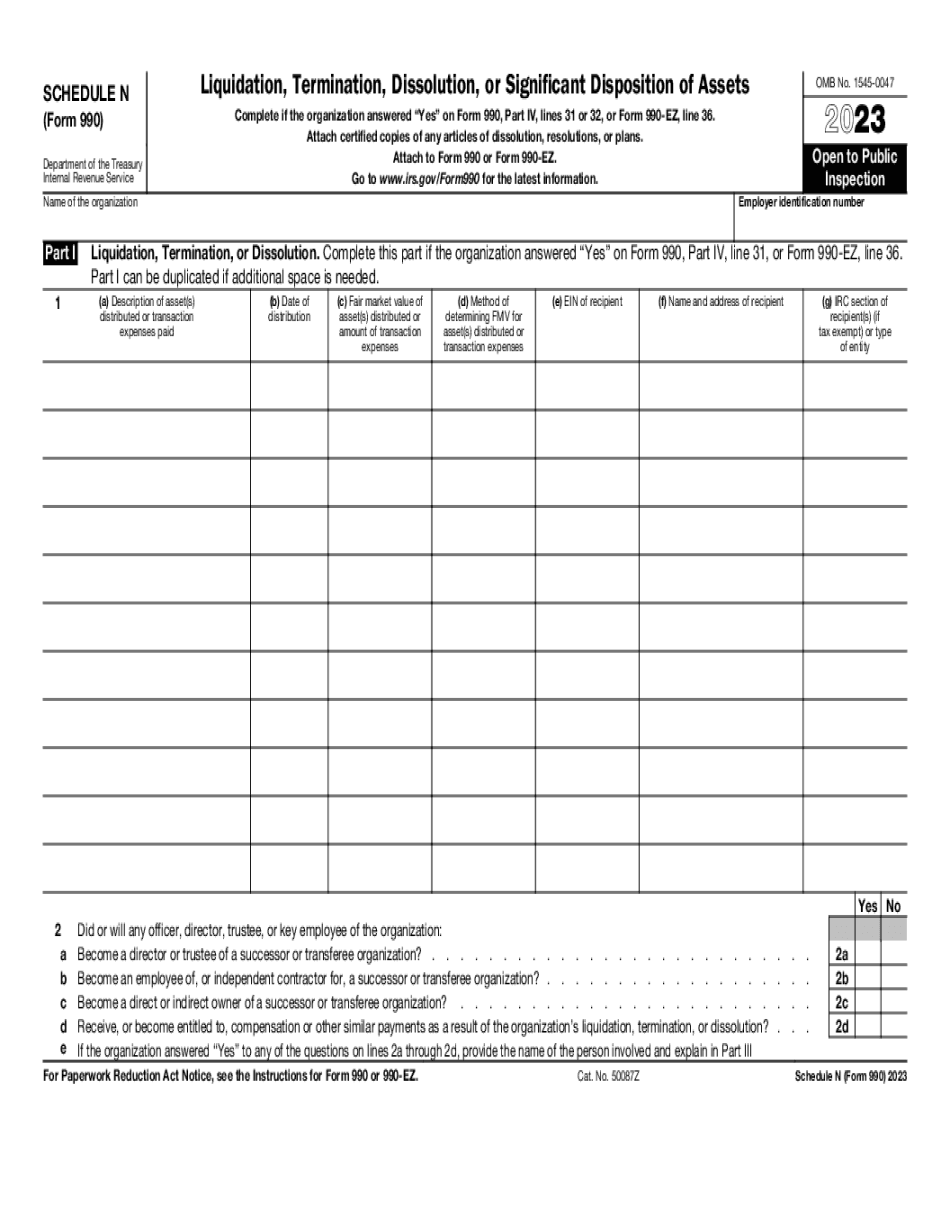

Form 990 or 990-EZ - Schedule N online LA: What You Should Know

Form 990-PF is generally filed by nonprofits whose gross receipts are more than 50,000. Forms 990-PF are used by these organizations for three purposes. If your organization meets the definition of a 501(c)(3), your organization's records must include Form 990-PF. Form 990-N — Business Income Tax Return for the Tax Year Form 990-PF provides information about the organization's gross receipts for the tax year, including a detailed breakdown and list of revenues for each entity or activity. Form 990-PF is filed by tax-exempt organizations whose gross receipts are normally 1,000,000 or less. This page provides a link to search for and view Form 990-PF “Form 990-PF: For Individuals Reporting Business Income, Federal Income Tax Return.” Form 9110 — Tax-Exempt Estates This form is used by nonprofits who are involved in the acquisition, holding, and transfer of real property. The Form 9110 form forms must be filed by organizations with income of more than 50,000 in a calendar year. Form 1010 — Education 501(c)(3) This form is used for charities and other tax-exempt organizations that are engaged in a legitimate educational, scientific, or educational institution, or in certain other activities that do not qualify as providing an “exchange of ideas.” Form 1065 — Federal Tax Return When an organization receives money through a governmental grant, the organization is known as a “donor” and the check is paid to an “administrating official” for the purpose of issuing a tax return. The form asks for the organization's name and street address. It also asks for the name and state of the organization's “federal tax home.” Form 1042 — Form 5500 for Sales/Exchanges for Real Property Other than Property of Other Organizations The Forms 5500 have been amended to include all the information that is reported to the Internal Revenue Service by Form 1041. Also, the form reports any items of information about real property, that would be required to be reported on a Form 1041. Form 1059-B — Schedule J for Individuals Reporting Income or Loss Thereof This form must be completed by each employee of an electing corporation. The Form 1059-B is used by the corporation to file Form 5500 for the corporation's income tax return.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 990 or 990-EZ - Schedule N online LA, keep away from glitches and furnish it inside a timely method:

How to complete a Form 990 or 990-EZ - Schedule N online LA?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 990 or 990-EZ - Schedule N online LA aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 990 or 990-EZ - Schedule N online LA from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.