Award-winning PDF software

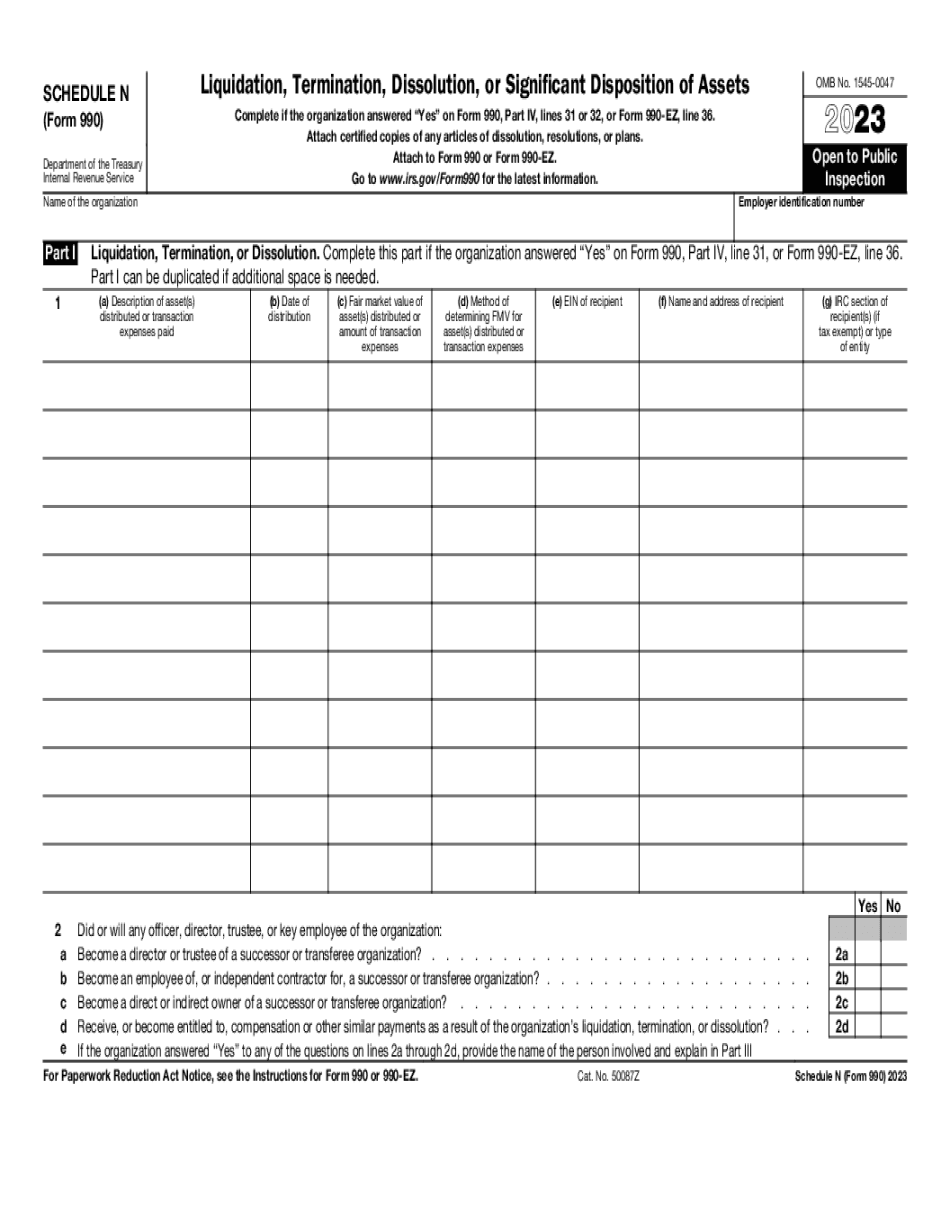

Form 990 or 990-EZ - Schedule N for Waterbury Connecticut: What You Should Know

For most nonprofit organizations, the tax code says they have to prepare and file Form 990. But you don't have to be a nonprofit to file one. Nonprofits have more flexibility and can use any form -- tax, 1099, Form 990, Form 990-EZ, or even a combination of the two. Form 990 has an extremely broad definition of the word “substantially.” The “substantially” language is in all the information-rich sections of the tax code. The word substantially means that the organization needs to show the actual dollar amount of their “income.” They have to prove that the amount is more than the average amount of nonprofit organizations, not less. It's a big task in any organization, but it's even bigger in nonprofits, which must spend hundreds of thousands of dollars on overhead in order to be considered “charitable.” Organizations that aren't organized as nonprofits can't claim substantial deductions, but Form 990 provides a list of tax-exempt organizations that meet the statute's tests for being tax-exempt. The IRS says that organizations with high costs -- salaries for top staff, advertising and promotion costs, office supplies and office equipment -- are more likely to be recognized as charities. In order to have a tax-exempt status, organizations have to spend a minimum amount of money on their operations. Since nonprofits can spend thousands of dollars a year on overhead, the definition of substantial spending means the value of the actual labor costs of the operation, plus the value of all the other things the organization pays for: the office space, the board members' salaries, the volunteer and clerical staff, and the equipment. But there's another way the IRS defines substantial spending: for those groups that report their activities on Form 990-EZ, the IRS says an organization's total operating expenses must exceed 45 percent of “your net assets.” In other words, if the net assets of your organization are 55,000, but your operating expenses total 180,000, they must be more than 50 percent of that. Those expenses are often what makes or breaks nonprofits. If the organization's operating expenses are more than 45 percent of its net assets, it will have to pay an excise tax of 1.4 percent of each dollar over the 45 percent maximum. And even if the “net assets” of a group are 150,000, but your organization's expenses total 240,000, it still has to pay the excise tax of 0.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 990 or 990-EZ - Schedule N for Waterbury Connecticut, keep away from glitches and furnish it inside a timely method:

How to complete a Form 990 or 990-EZ - Schedule N for Waterbury Connecticut?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 990 or 990-EZ - Schedule N for Waterbury Connecticut aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 990 or 990-EZ - Schedule N for Waterbury Connecticut from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.