Award-winning PDF software

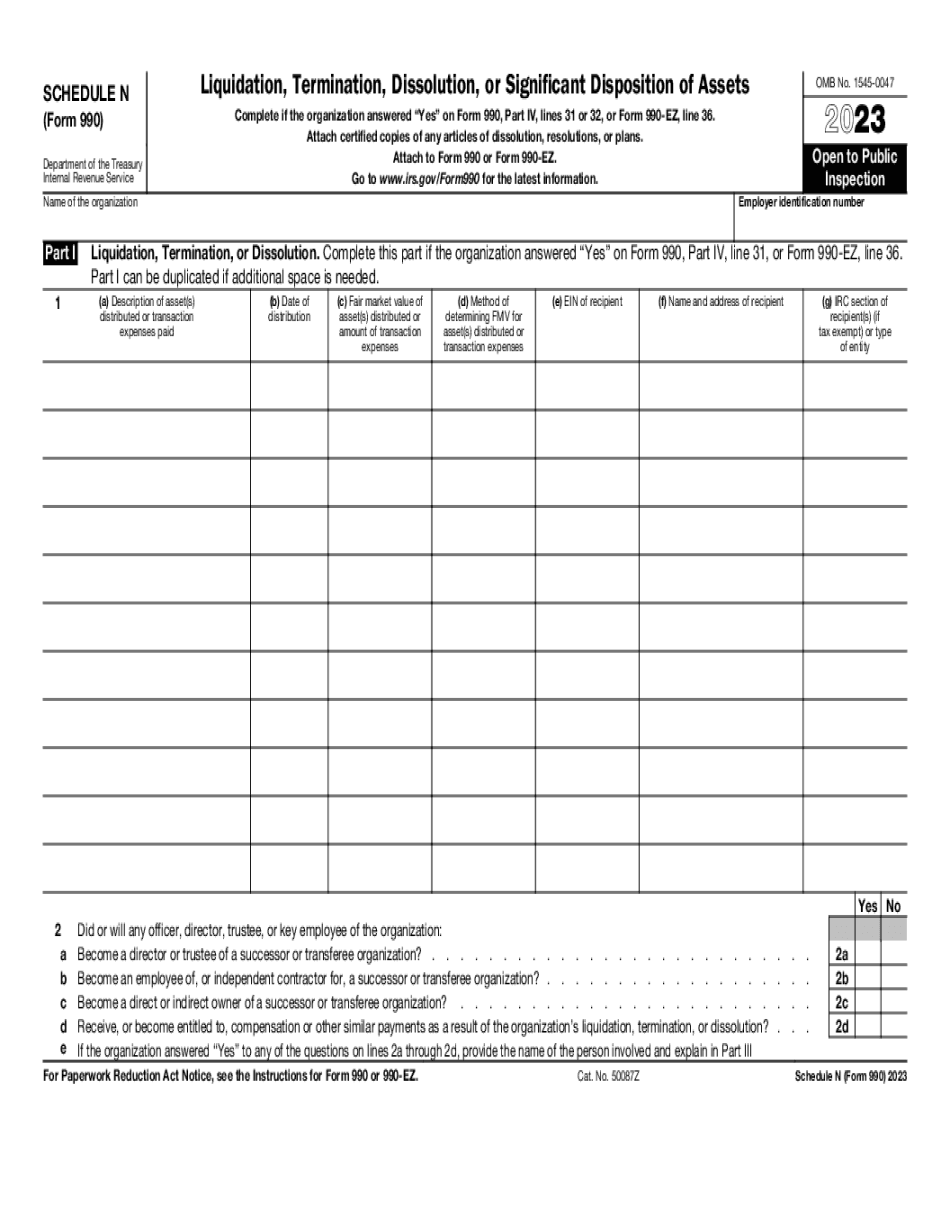

CO online Form 990 or 990-EZ - Schedule N: What You Should Know

If an organization reports less than 50,000 in gross revenues, a Form 990 is due and payment is required the following calendar year. Taxpayers filing Form 990-EZ pay their share of the tax liability by checking the appropriate box on Form 990 on the first page of the Form 990-EZ. If the organization file its own return, complete Form 990-OID and complete Form 990-EZ. You may need to use IRS-to-IRS Web Services (WINS) or an on-line service to do certain things, such as filing a W2, making an Estimated Tax Payment (ITP), or making a W-4. File a Form 990-EZ even if an Internal Revenue Service (IRS) Form 990 was filed. File Form 990-EZ as early as one year after the organization completed processing for its tax year. The Form 990-EZ form includes instructions and information on where to file it. See IRS Publication 959 for more information about filing and reporting as a nonprofit. 2022 Publication 959 — IRS Publication 959 explains a nonprofit's filing requirements and provides guidelines and examples. Forms 959 are the first step for taxpayers to determine whether nonprofit organizations like churches should file tax-exempt status as “social welfare organizations.” Publication 959 also contains information on how nonprofit organizations process their tax returns. Publication 959 is available on the IRS Website. If you have any questions about Publication 959 or about Form 959, contact your tax adviser or a tax professional at your tax agency. A tax professional at the IRS can answer questions about the law, what the law requires, and where you can go to make a decision about exempt status for your organization. You also can contact the IRS for additional information. If you decide to file Form 959 or to have someone other than your tax adviser prepare and file Form 959 to prepare it, it's important to have everything completed accurately. If the information is missing or incorrect, your Form 959 will be returned to you, and you'll have to start the process all over in order to correct the errors. If you choose to have someone other than your tax adviser file your Form 959, your Form 959 may be subject to review by the IRS. All instructions and forms submitted with Forms 959 must be completed accurately.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete CO online Form 990 or 990-EZ - Schedule N, keep away from glitches and furnish it inside a timely method:

How to complete a CO online Form 990 or 990-EZ - Schedule N?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your CO online Form 990 or 990-EZ - Schedule N aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your CO online Form 990 or 990-EZ - Schedule N from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.