Award-winning PDF software

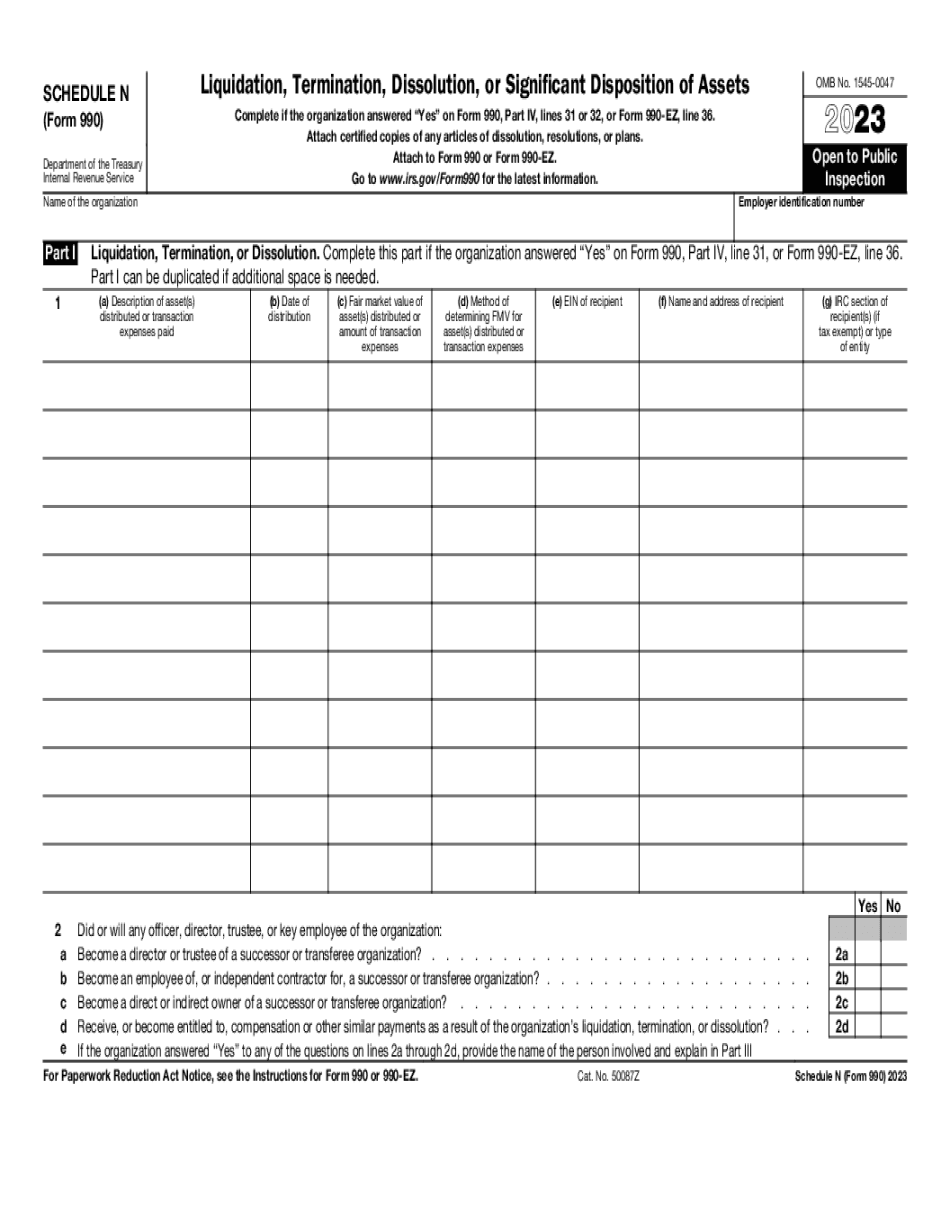

Form 990 or 990-EZ - Schedule N Virginia Fairfax: What You Should Know

G Indicate the date the payment was made. Frequently Asked Questions (FAQ) — Southern California Foundation for the Arts If more than one charitable organization reports the same amount to the IRS, they must agree for each amount to be attributed to the same “charitable organization.” OF Nonprofit Explorer — NORTHERN VIRGINIA CHAPTER-AMERICAN GOODALL, VA 22031 | Nonprofit since 1996 Lists all income and expenses since 1998 on Line 10 of Schedule O, Part I. Nonprofit Explorer — Fulfilling — News Apps — ProPublica Fellowship of Christian Athletes Form 990, Statement of Compliance With IRS Regulations Regarding Nonprofits OF Nonprofit Explorer — NORTH CAROLINA CHAPTER-AMERICAN Cary, NC 27806| Nonprofit since 1995 Information about Form 990, line 32 in Schedule O, Part II. L Describe the activities, activities that are conducted with a religious purpose and activities that are conducted outside North Carolina. Nonprofit Explorer — Non-Profits — News Apps— ProPublica The Fellowship of Christian Athletes' website is at . Go to for instructions and the latest information. Frequently Asked Questions (FAQ) — Southern California Foundation for the Arts If more than one charitable organization reports the same income and expenses, they must agree for each amount to be attributed to the same “nonprofit.” Nonprofit Explorer — SOUTHERN CALIFORNIA CHAPTER-AMERICAN FORT JACKSON, FL 33401| Nonprofit since 1996 Lists income and expenses for 1998 from Schedule O, Part I, as well as income on Form 990. L, Statement of Compliance With IRS Regulation Regarding Nonprofits. Nonprofit Explorer — Fulfilling Grants and Contributions — News Apps — ProPublica GOODALL, VA 22031 | Nonprofit since 1997 for grants, contributions, and sales (Form 990) Lists donations under the following categories in Schedule O, Part II: Gifts made by corporations, partnership, or LLC, and donations and grant orders made under federal and state laws.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 990 or 990-EZ - Schedule N Virginia Fairfax, keep away from glitches and furnish it inside a timely method:

How to complete a Form 990 or 990-EZ - Schedule N Virginia Fairfax?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 990 or 990-EZ - Schedule N Virginia Fairfax aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 990 or 990-EZ - Schedule N Virginia Fairfax from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.