Award-winning PDF software

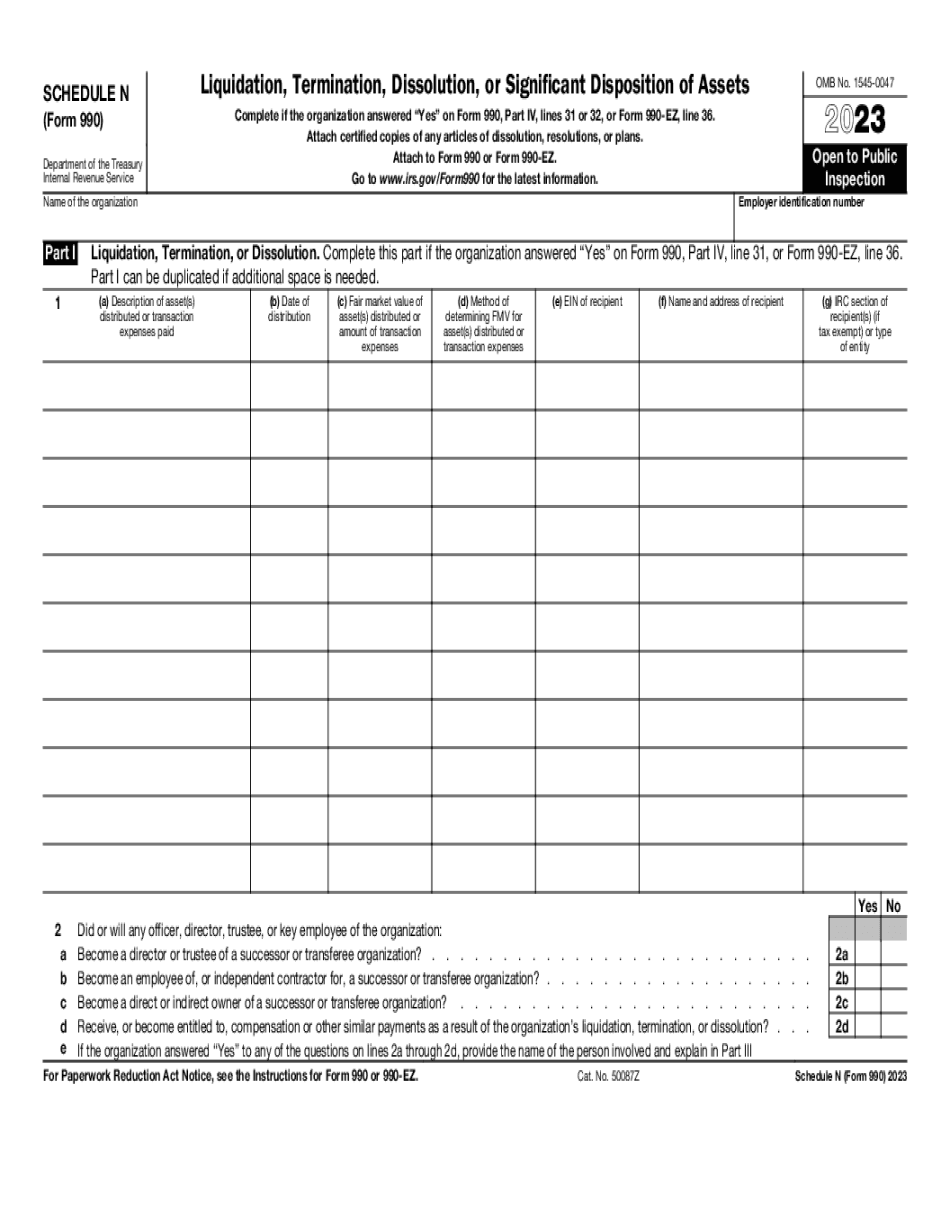

Form 990 or 990-EZ - Schedule N for Santa Clara California: What You Should Know

No No SO, Inc. — Form 990 — Voluntary Information Return for Private Foundation. For information about the non-profit business entity's financial and operations activities: • Identify the charitable activities the organization engages in • Indicate whether the activities involve contributions, grants, and other financial aids for which there is a tax deduction for the donor; and • Indicate whether the organization also engages in • Whether the organization receives financial support from private individuals (including foundations or other organizations) or institutions; and • Indicate whether the organization is a member of a nonprofit organization if such a membership designation would increase the organization's ability to receive financial assistance from The IRS recommends that a charitable organization provide complete disclosure for each of the charitable activities and all other financial and operating support (including the financial support of private individuals) it provides to its eligible members. Volunteerism is all about giving your time and money to help others. As a 501(c)(3) nonprofit, an organization can accept monetary contributions. A contribution is any amount of money or property given by an individual, organization, or another type of transaction. Noncharity organizations often make substantial donations to help fund a program. In some cases, however, nonprofit organizations only accept tax-deductible contributions. Donations from private individuals or groups that do not accept tax-deductibility are treated as taxable. Donations are required to be declared to the nonprofit organization no later than the date of gift. If an organization receives a donation from an individual, organization, or other type of transaction, donation information is not required. The IRS also recommends that a charitable organization provide complete disclosure for each of the charitable activities and all other financial and operating support (including the financial support of private individuals) it provides to its eligible members. Organizations that fail to provide complete financial disclosures could be subject to fines of up to 50,000 and up to 5 years in prison. Donations made to an organization for expenses and in no way represent charitable expenses are not included in its income. Organizations must complete this section by the date of the most recent annual report (usually the date of the organization's most recently filed Form 990).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 990 or 990-EZ - Schedule N for Santa Clara California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 990 or 990-EZ - Schedule N for Santa Clara California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 990 or 990-EZ - Schedule N for Santa Clara California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 990 or 990-EZ - Schedule N for Santa Clara California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.