Award-winning PDF software

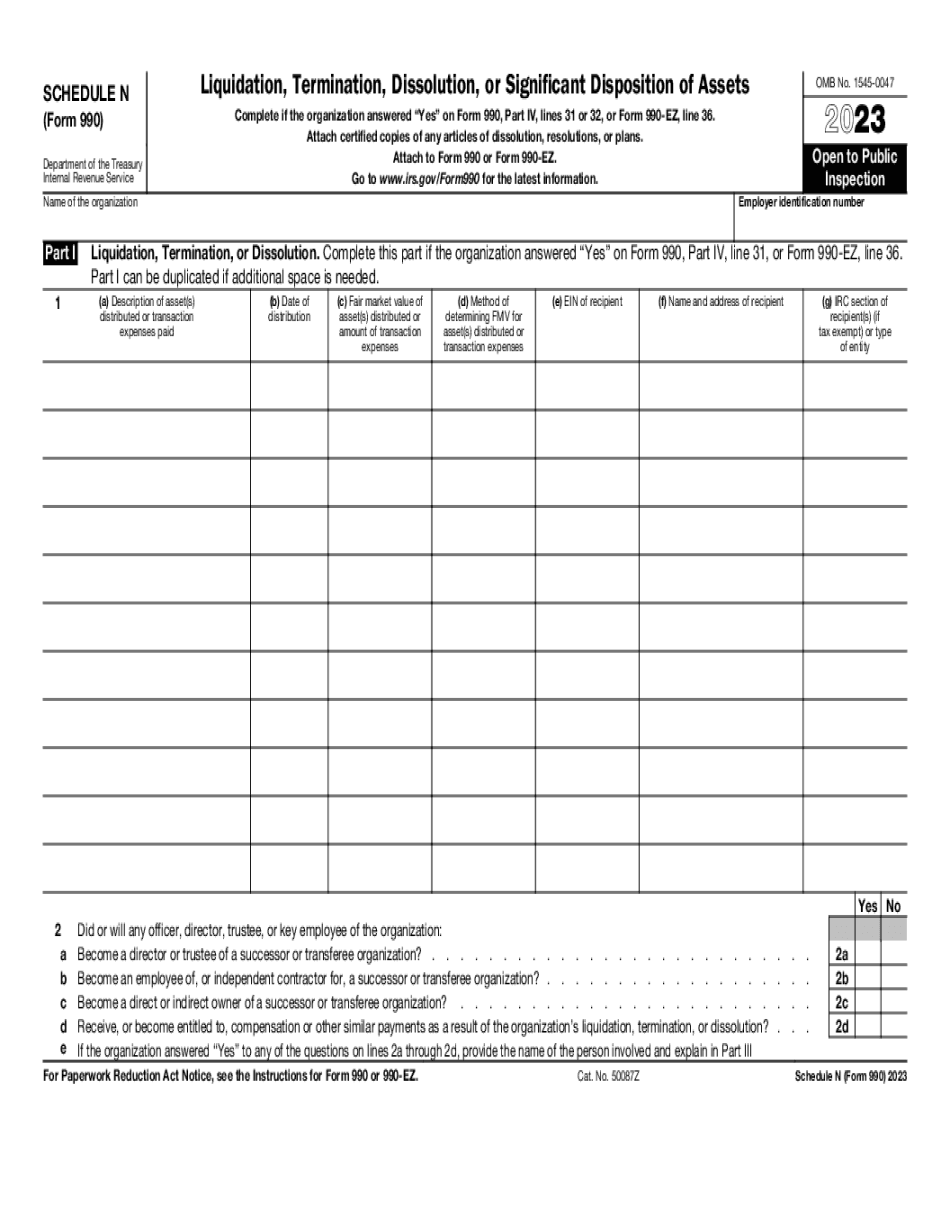

Salinas California Form 990 or 990-EZ - Schedule N: What You Should Know

EZ (filed on Nov. 30, 2017) · 73,721.65 ; 2024 · 990EZ (filed on Dec. 3, 2016) · 63,200 ; 2024 · 990EZ (filed on Nov. 30, 2014) · 52,000 ; 2024 · 990EZ (filed on Nov. 17, 2013) · 49,000 ; 2012 Salinas Rotary Club Charitable Fund — IRS Schedule N-G 2018 1. NAME OF ORGANIZATION: SALINAS ROTARY CLUB CHARITABLE FUND. 2. SHAREHOLDERS: The Company has a single class of membership interests; consisting of a membership base consisting of 50 members and individual memberships. The Company generally does not issue a dividend. A majority of its stock is owned by its memberships. No members, directors, or officers are currently serving as members. In 2017, there was only one shareholder, the sole member of the board of directors, who serves as sole director and sole member of the annual meeting. A minority interest of the Company's stock and interests held by its members or other persons are held in trust for the benefit of the members. The benefits that may accrue to the members and holders of the members' interests in the Members' Trust or Members' Benefit Trust are specified in the Members' Trust Agreement. 3. CURRENT TAX STRUCTURE AND BASIS OF ASSETS: The present value of the assets of the Company and those of the Members' Trust as of June 30, 2018, was 1,099,300,000, based upon the closing price of the Company's Common Stock of 35.07 on that date. 4. CURRENT YEAR RESULTS: During the fiscal year ended June 30, 2018: (A) income taxes have been reduced through amortization of deferred income taxes and reductions in deferred income tax assets as a result of the resolution of significant tax audits. (B) the Members' Trust will be converted into the United States Federal Employees Retirement System (“FEES”) account with a stated value of 30,000,000, and all contributions will be made to the FEES account.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Salinas California Form 990 or 990-EZ - Schedule N, keep away from glitches and furnish it inside a timely method:

How to complete a Salinas California Form 990 or 990-EZ - Schedule N?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Salinas California Form 990 or 990-EZ - Schedule N aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Salinas California Form 990 or 990-EZ - Schedule N from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.