Award-winning PDF software

Garden Grove California online Form 990 or 990-EZ - Schedule N: What You Should Know

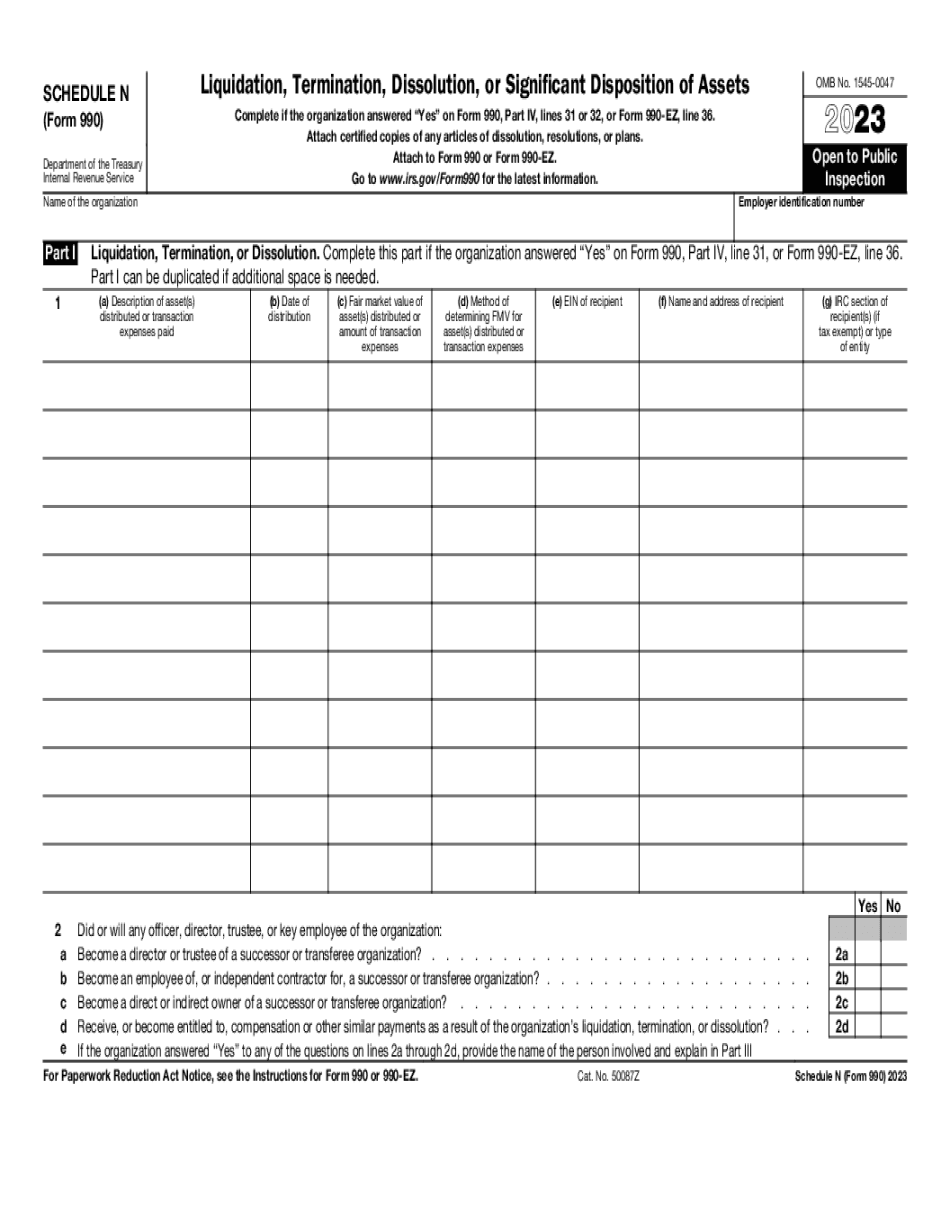

Phone. The IRS, as they must comply with the tax code, will also accept this online Form 990 instead of sending it by mail or in person to the PO Box: PO Box 1226, Sacramento, CA 95. In the “Obligation to Report and Pay” section for the Form 990-EZ, find out how to claim a charitable deduction of up to 35% of your income-tax liability at the bottom. The IRS Form 990-EZ — Schedule N and the IRS Form 990 can be helpful as both are used to file an annual return detailing: How and when the organization's assets will be transferred to another group, such as a foundation, charity or private business. In the IRS Form 990 — Schedule N, enter the amount (including interest) in the box for the amount, including capital gain, of all distributions (after netting out all distributions from the previous return) received from the organization. In the IRS Form 990-EZ, enter a total of total contributions, total amounts repaid by the organization, amounts paid for operating losses and expenses and other contributions that need to be reported. The total amount reported would be the total of the contributions. This year the organizations were required to disclose this information on the website as well as provide it to the IRS. There was some confusion that the Form 990-EZ was for public distribution, and you can look at the details of the form that are published here. The information that is shown here is not a list of every entry that was reported and is not a complete list of all entries which may be reported by the organization. Some entries may have been made that were not reported and will be reflected in the next available year. See IRS Form 990-EZ — Schedule N for more information. Some information in the Schedule is the same as reported on the tax return. However, there may be some differences with any changes to the status of a charity as opposed to a private foundation. The date range of the information is reported by the organization for those items that are not listed on the return. The tax returns may also include a section called “Other Income” and contains amounts from the organization for the following items: Payments from other sources (such as insurance or employee salaries) that were not reported as contributions in the prior year.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Garden Grove California online Form 990 or 990-EZ - Schedule N, keep away from glitches and furnish it inside a timely method:

How to complete a Garden Grove California online Form 990 or 990-EZ - Schedule N?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Garden Grove California online Form 990 or 990-EZ - Schedule N aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Garden Grove California online Form 990 or 990-EZ - Schedule N from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.