Award-winning PDF software

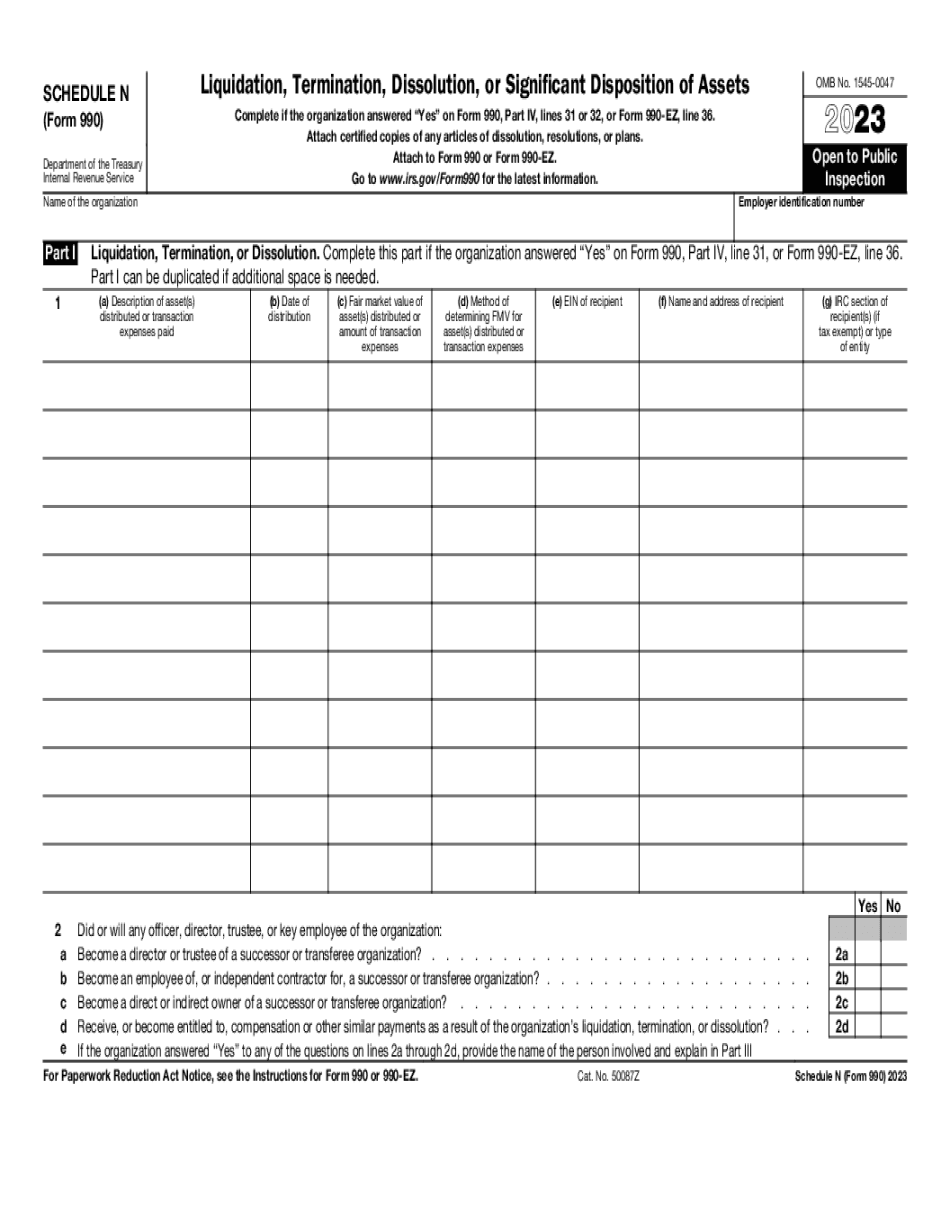

Form 990 or 990-EZ - Schedule N online West Covina California: What You Should Know

D. E. 2021 Instructions for Schedule C (Form 990) — IRS See separate instructions for Schedule C under Part II. I (IECF-Form_PUBLIC.pdf) Part II. Lobbying activities. D For the 2024 calendar year, or tax year beginning and ending. I. Exempt Organization's purpose. J All other lobbying expenditures shall not exceed 5,000 in any calendar year. K An election to deduct a reasonable portion of any qualified organization expenditures for communications required under IECF-Form_PUBLIC.pdf Inspection. Go to for instructions and the latest information. IIC. Lobbying expenses shall be limited to amounts expended for: I. Communications to members of Congress or representatives of interested interest. II. Publications and press releases. II. Education of Government and the public. II. Research and public information. III Communications to Members of Congress and Representatives of Interest. III. Education of Government and the public. III. Research and public information. 2017. Form 990. Return of Organization Exempt From Income Tax. 2017. Section 501(c)(3), Section 501(a), or Section 527 of the Internal Revenue Code (527). I. Nonprofit. The organization was organized or organized by the Government and is exempt from income tax under section 501(c)(3) of the Internal Revenue Code or section 501(a) of the Internal Revenue Code. (IRC § 501(c)(3), IRC § 501(a), or IRC § 501(a), or Regulation E-531 under 31 U.S.C. Sec. 1320a–7(c)(6)). J The qualified nonprofit organization had a net income in its immediately preceding tax year (or for tax years beginning before 2017, has not had a net taxable income in the preceding two years) of at least 600,000. K A qualified non-profit organization is one organized and operated exclusively for a religious, educational, fraternal, humanitarian, scientific, testing for public safety, literary, or scientific purpose, or socially or environmentally progressive purpose or cause and is exempt from Income Tax under subsection (c) (relating to certain trusts) of section 501(c) of the Internal Revenue Code or regulation under 31 U.S.C. section 527 (relating to certain tax-exempt organizations).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 990 or 990-EZ - Schedule N online West Covina California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 990 or 990-EZ - Schedule N online West Covina California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 990 or 990-EZ - Schedule N online West Covina California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 990 or 990-EZ - Schedule N online West Covina California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.