Award-winning PDF software

Atlanta Georgia online Form 990 or 990-EZ - Schedule N: What You Should Know

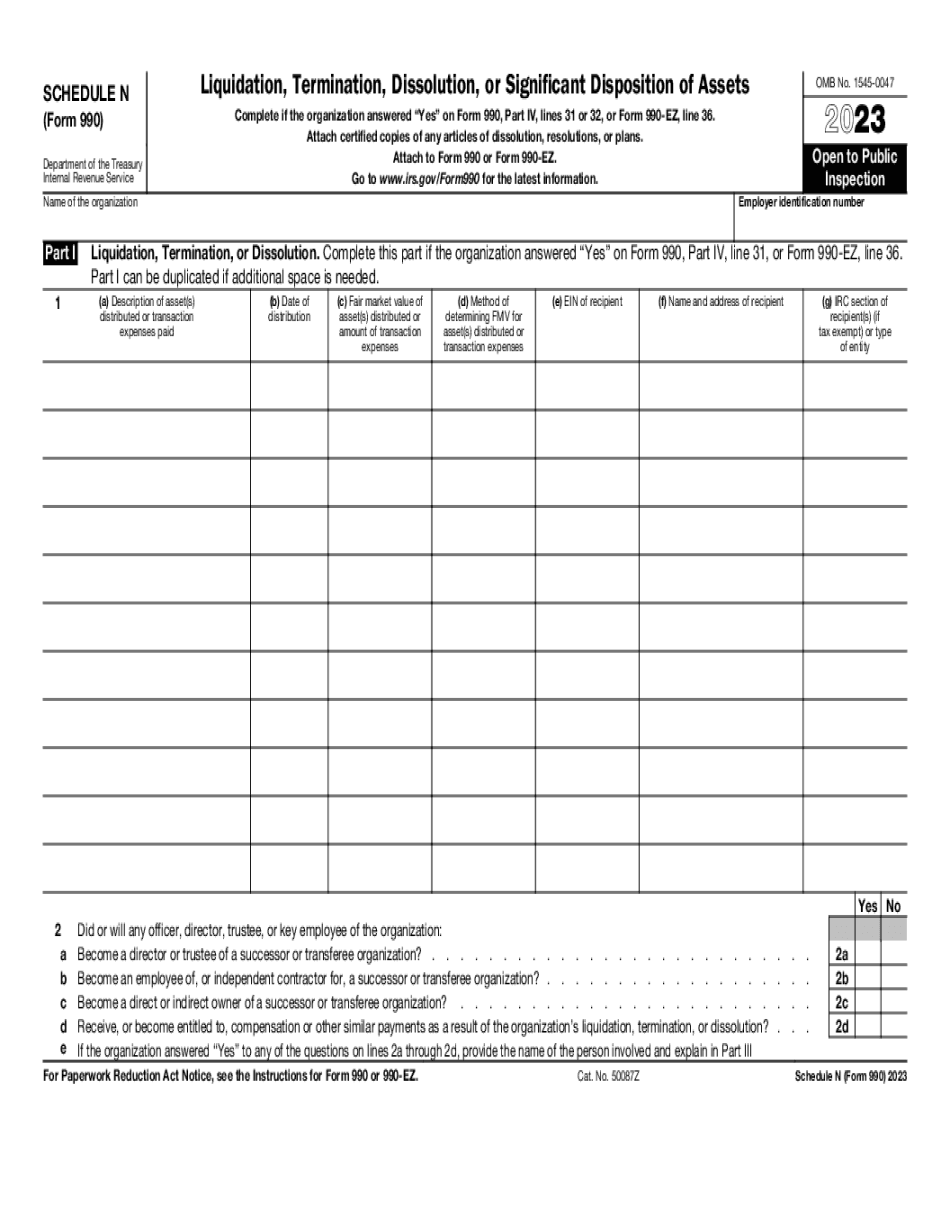

PDF, 2016-NGCF-990-US.pdf Form 990 1. What is Form 990? A Form 990 is a paper-based document filed with the Internal Revenue Service (IRS) that shows how much money your organization has brought into your local community and how much it has spent in your community. These reports are used by the IRS to determine if an organization is tax-exempt. Forms 990 are used to determine tax-exempt status for tax-exempt organizations that are not churches, religious groups, or trade associations. What to consider on your Form 990 In the beginning your Form 990 must provide some basic information about your charity's mission and finances (like annual donations, staff, and other expenses paid for by your organization and local communities). Your Form 990 can include information from previous years, but the IRS typically requires that organizations make some substantial changes to their Form 990 for 2017. After you fill out your 2024 Form 990, send it in by certified mail or fax so that you can get the report published online within 1-2 weeks by the IRS. When you file your Form 990, you're supposed to: · state the names and addresses of your staff; · list all your donors; · state your budget; · state you're spending (including funds spent on public relations, marketing, and fundraising). · state your spending in local communities (including money spent on projects such as community gardens); · list all the people and organizations that you work with in addition to your donors, including the names and locations of those organizations; and · list the names, addresses, and phone numbers of your other officers. A charity may also need to file Form 990 every year during which it does certain activities (like paying employees) that could result in substantial financial reporting. These are all the reports that the IRS requires all non-profit organizations to file. The organization should be able to demonstrate, for each of these activities that may require Form 990, that it provides a clear and convincing response to the question: “Did the organization conduct business in the community? Did the organization engage in activities for the community or community groups by providing information or support in lieu of monetary donations?” Filing Schedule N.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Atlanta Georgia online Form 990 or 990-EZ - Schedule N, keep away from glitches and furnish it inside a timely method:

How to complete a Atlanta Georgia online Form 990 or 990-EZ - Schedule N?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Atlanta Georgia online Form 990 or 990-EZ - Schedule N aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Atlanta Georgia online Form 990 or 990-EZ - Schedule N from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.