Schedule K. Interest income, gain, loss, or deduction from: (1) Property not

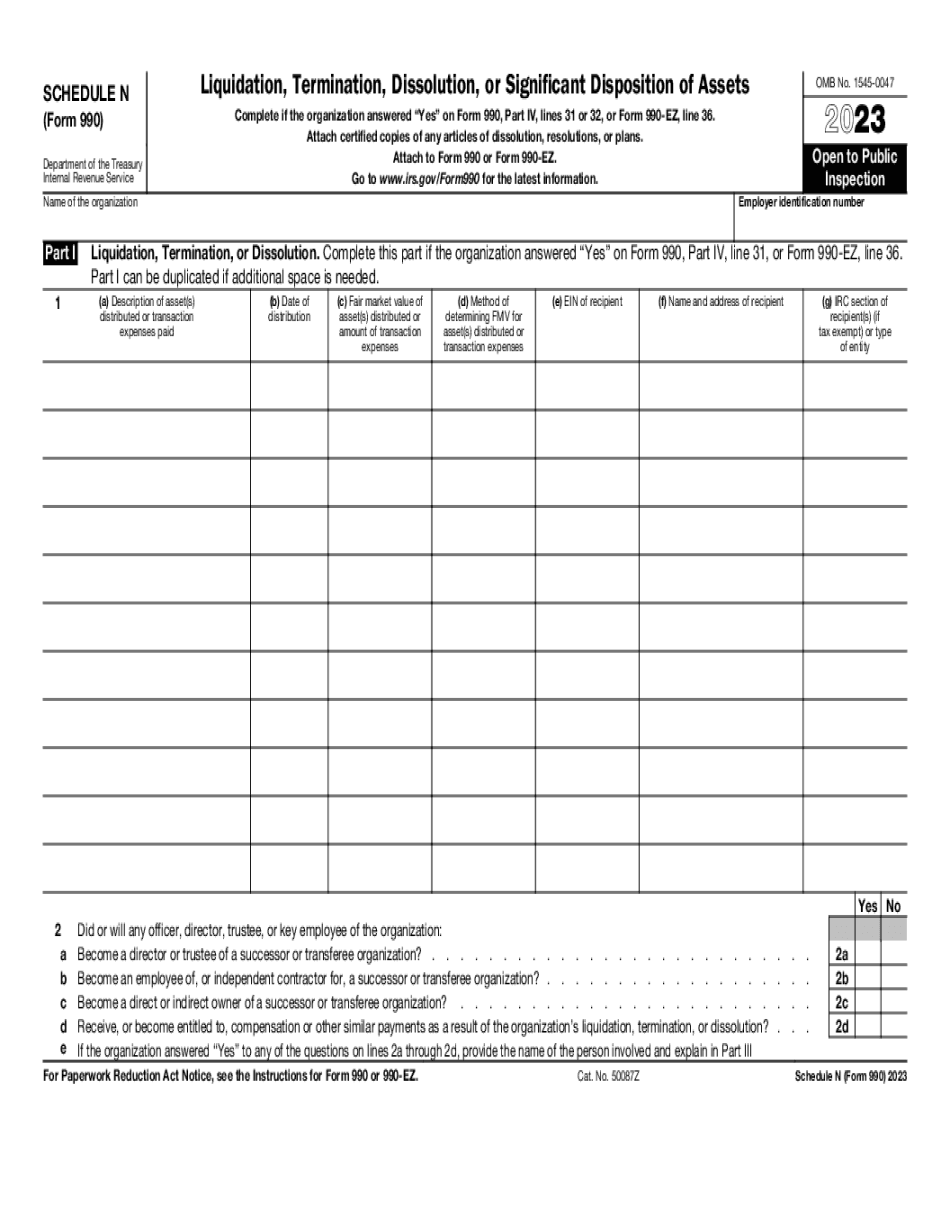

Schedule K. Interest income, gain, loss, or deduction from: (1) Property not subject to tax, under section 1242, and other deductions; (2) Interest paid, or accrued or due, to a private foundation; (3) Interest paid, or accrued or due, on or with respect to securities issued by a private foundation or partnership or issued to the government; and (4) Interest paid, or accrued or due, to another individual in a trade or business carried on under a non-for-profit organization. Schedule L. Other income from: (1) Interest, dividends, or other remuneration (for example, salary, commission, or royalties); (2) Payments of the Federal Insurance Contributions Act (FICA); and (3) Capital gains. Schedule M. Other income from: (1) Interest, dividends, or other remuneration (for example, salary, commission, or royalties); (2) Payments of the Federal Insurance Contributions Act (FICA); (3) Capital gains. Schedule N. Schedule N. Other income from: (1) Payments of Federal insurance premiums received; (2) Payments of employer tax or other employer contributions (for example, retirement and disability earnings in excess of 400,000) or other employer payments of which the employee was not required to make; and (3) Capital gains. Schedule O. Schedule O. Other income from payments of Medicare Part B premiums or the Indian Health Service premiums. Schedule Q. Schedule Q. Other income from a payment by an individual who is a resident of a taxing jurisdiction with a social security contract program.

In addition, “the company is conducting an evaluation of its consolidated

The company is moving its operations into “tax-efficient” jurisdictions and is “committed to a more aggressive and transparent approach to reporting and auditing” in the U.S. PwC currently employs the same accounting practice that led to the audit results in 2012/2013. As a result of those changes, “Ira C. Smith is no longer serving as a member” of the board. In addition, “the company is conducting an evaluation of its consolidated operating structure, and will be making decisions regarding future reorganization in the near future.” This “evaluation will help us determine how we will proceed” going forward with new business and strategy, the company says. “We also expect this evaluation to have a positive or negative impact on our financial results in the future.” The CEO says they will be “more careful” and disclose more soon: “We must be able to be transparent with our shareholders and I want to explain this more immediately at the company's shareholder call.” Shareholders, in case you missed it, are still trying to decide whether to keep the company's board or split it up for better corporate governance and a more effective board of directors. As of today the stock price is at.

PwC reports this investment and transaction through the U.S. equity and fixed

Form 990, page 10. PwC 2013 Form 990, page 10 PwC, page 17 (10/19/2011). PwC, page 17 (10/19/2011). PwC 2013 Form 990, page 21. The first reportable investment and the first reportable transaction were also eliminated due to reporting changes prior to FY 2011. PwC reports this investment and transaction through the U.S. equity and fixed income lines of business in line 16b or line 17. This investment in a foreign affiliate does not have to be reported on Form 5562. It is reported in the foreign affiliate's Form 990 information section even if this entity does not have any income from U.S. sources (or any reportable income of any kind): Form 4562, Investment Income and Expenses of Foreign Corporations, line 6a. PwC reports this investment and transaction through the U.S. equity and fixed income lines of business in line 16b or line 17. This investment in a foreign affiliate does not have to be reported on Form 5562. It is reported in the foreign affiliate's Form 990 information section even if this entity does not have any income from U.S. sources (or any reportable income of any kind): Note: The information that is reported on Form 990 is generally included on Schedule O (Line 20) of the Form 940. Form 990, page 18 Form 990, page 21. PwC 2013 Form 990, page 22. The Form 990 includes information on which this investment has been distributed/disposed of, by type of payment: Capital payment in connection with the closing or exercise of an outstanding option/bond (or.

In the interest of being complete and accurate, the forms may not include

Form 990, 990.9 and 990.10; and Modeled after Form 990 | and IRS Form 990 — and filed by Non-Profit Organizations. The Public, you and Other Organizations | Are entitled to a copy of this Form 990, 990.9 and 990.10, even if you are not a Tax-Exempt Organization. The forms are prepared annually for each of the several years. All the information about the Non-Profit Organization and its related activities are included, including all amounts paid during the reporting period. There are additional requirements for non-profit organizations than for for-profit organizations, some of which are listed in the following sections. In the interest of being complete and accurate, the forms may not include entries or details that, when included, would constitute “failure to file” as defined by section 7805(c) of the Internal Revenue Code(s), and as provided for by sections 6707 and 6621(a)(1)(A), or as required by Regulations sections 1.1(q)(3) and 1.1(w)(5), or “failure to file” as defined in section 6707 or Section 6621(a)(1)(A)(1), or “failure to file” as defined by section 6707A of the Internal Revenue Code(s). The Forms 990 must be filed and all required schedules attached within the proper time limits. You can read all 990 forms filed between 1993 and 1999 on IRS.gov or in the following links: — General Tax Information; — Forms 990, 990.1, 990.2, 990.3, 990.4, and the 990.5 Schedule; — Form 990.6A and Forms 6077 and 6675, and Schedule T; — Forms 6670, 6699,.

If your organization's taxes were filed by the Federal Government, then you

If your organization's taxes were filed by the Federal Government, then you will find a link to your individual tax return there. (Note: If you believe a form 990 should not appear here, please contact the IRS on their website. How to File a 990-EZ You can file your 990-EZ electronically, even if you are a for-profit corporation. (This requires an IRS account number.) You can also file a Form 990-EZ with the U.S. government if you are an independent contractor, and you file the form electronically. See “How Do I File a 990-EZ Online?” for information on filing Form 990-EZ electronically. To use the filing software, go to My Government Account online and find your account number. Log in using the account number, then open My Government Account Online. Select the organization's main page. Select Form 990-EZ, select Electronic Filing and follow the instructions to file the form online. Note: Federal tax returns are prepared on paper by the taxpayer, accountant, law firm or government entity. Therefore, print-outs from your forms, e-statements, or paper statements are not accepted. To complete a paper return, see Form 940 and Form 940A. If you preferred printing an official tax return, see Form 941, Post-Boxed Official Return. If you have multiple employees, see Tax Guide for Small Business, Chapter 1. To send electronically filed returns to a state or municipality, do not use the IRS' State E-File website. Instead, you can use the appropriate State E-File website,.

Award-winning PDF software